What docs are they asking for? I thought small land donít need any docs just signing that one form?

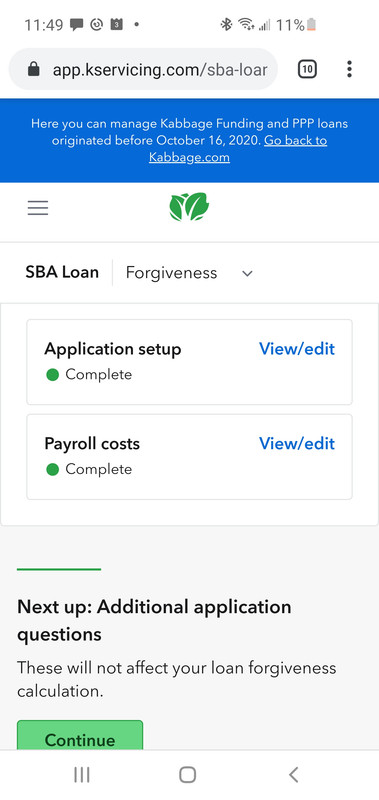

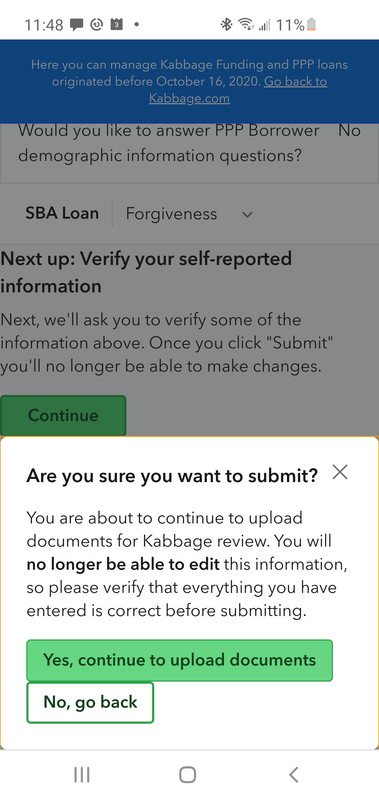

Not exactly sure, but see screenshots attached.

If your loan is under $2M I believe, it automatically says that you qualify for some simpler form.

There's a few questions to answer for application setup and for payroll costs, then there's a couple more before you get to the submit button where it mentions uploading documents. I haven't pressed submit yet, so I don't know what happens next.