Credit Bureau Info:

Experian: 800-493-1058 With A Report Number

Experian: 714-830-7000 (Without A Report Number) Call and Press 0. You will get connected to the switchboard operator. Tell them you just called in and entered your report number and the automated system disconnected you. Ask them if they can get a human on the line for disputes. That's the only way you'll be able to get through to a live person at Experian without a Report Number.

Equifax: 800-846-5279

TransUnion: 800-916-8800

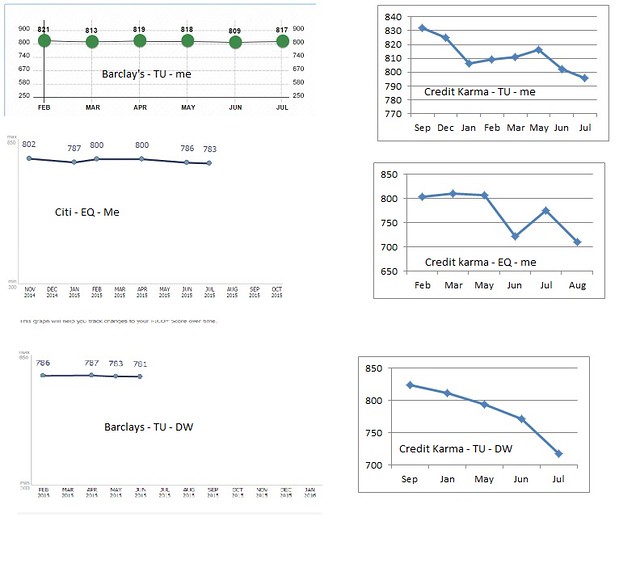

Comparison between FAKO from Credit karma and FICO from Barclays and Citi.

Cards that give you free monthly FICO's

AMEX personal cards =

Chase Slate = EX (either 08 or Bankcard enhanced)

PSECU = EX 04

Citi branded cards = EQ 08 Bankcard enhanced

Citi AA = EQ bankcard enhanced

DCU= EQ 04

PenFed = EQ NextGen

Elements Financial (Credit Union, score available for without opening CC) = EQ 5

Barclays = TU 08

Discover it = TU 08

Walmart (store or MC) = TU 08

« Last edited by Lev26 on April 13, 2022, 02:28:07 AM »

Topic Wiki

Topic Wiki